Commercial Real Estate Index

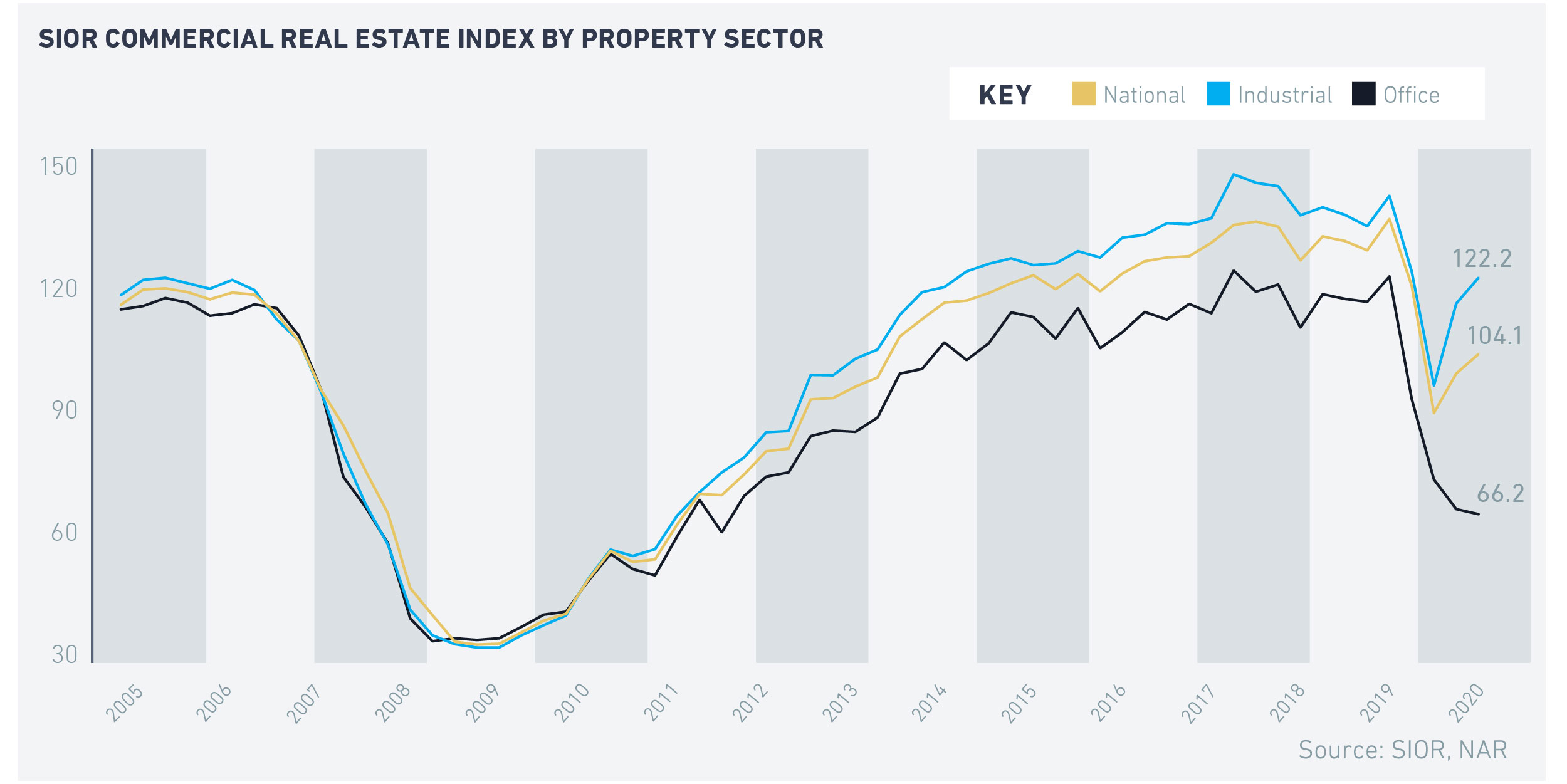

The industrial property market continued to strengthen in the fourth quarter of 2020, while the office market further weakened, based on a survey of SIOR members1 about their sales, leasing, and development activity in their markets.

In the fourth quarter, the SIOR Commercial Real Estate Industrial Index rose to 122.2, while the SIOR Commercial Real Estate Office Index continued to decline to 66.2. The overall SIOR Commercial Real Estate Index, which captures conditions in both markets, rose to 104.1. An index above 100 indicates that market conditions are positive, whereas below 100 indicates conditions are negative.

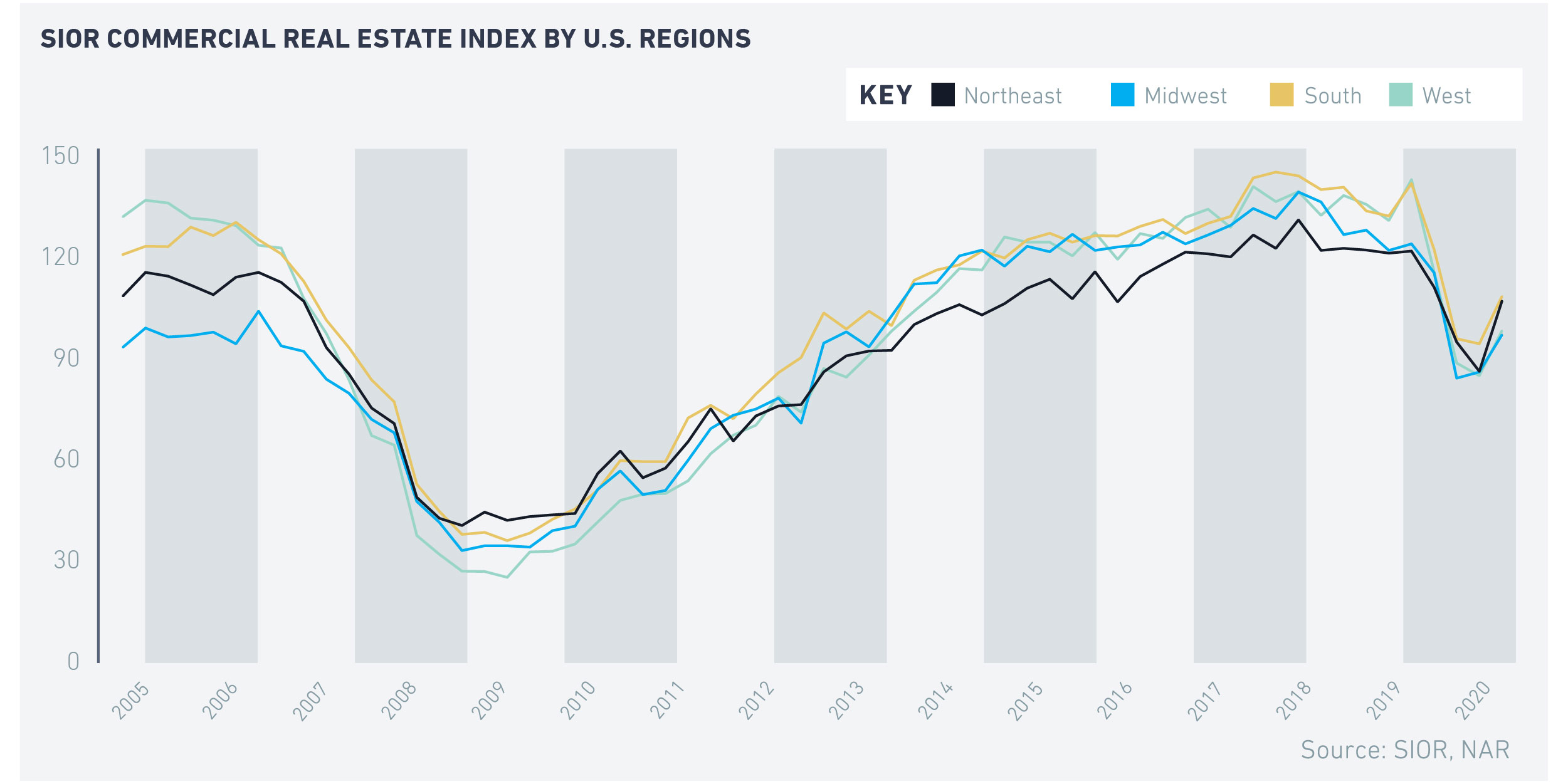

However, commercial market activity remains far below pre-pandemic levels, particularly in the office market: the overall index is 24% below its level one year ago, the office index is down by 46%, and even the industrial index remains down by 14%, despite the acceleration of e-commerce sales that is served by a network of warehouses and distribution centers. All regional indices have been trending upwards, but the indices remain below pre-pandemic levels.

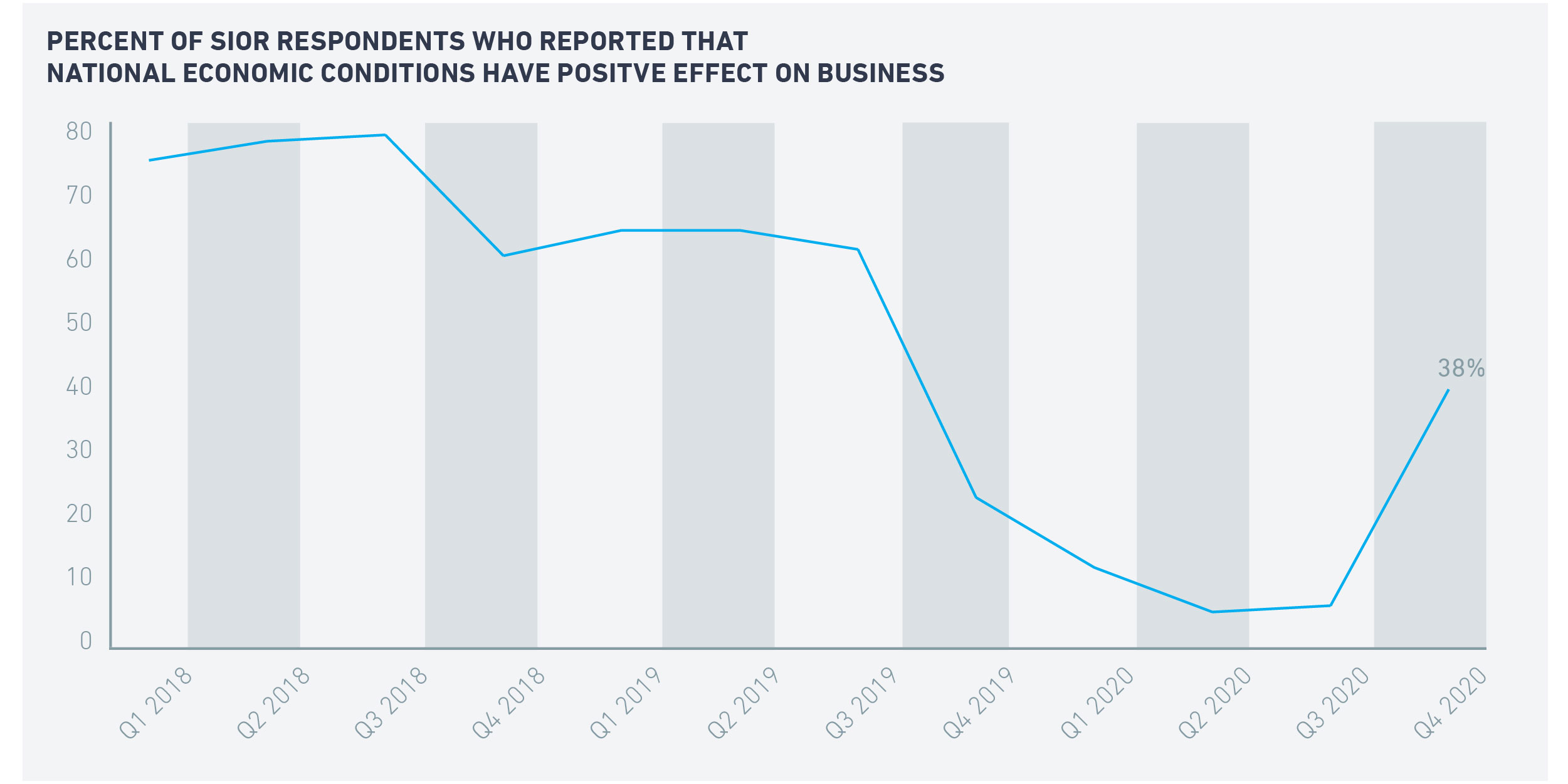

COMMERCIAL REAL ESTATE IS SLOWLY RECOVERING AMID IMPROVING ECONOMIC CONDITIONSImproving economic conditions are spurring the commercial market’s modest recovery, with 47% of respondents reporting that national economic conditions have a negative effect on market performance in the fourth quarter, a lower share compared to about 80% in the second and third quarters of 2020. About half of SIOR members who responded to the survey expect an increase in commercial activity in the first quarter of 2021 compared to the fourth quarter.

In the information, financial activities, and professional and business services industries (which can be considered as “office-using jobs”), 1.6 million jobs have been created since May, although 1.2 million jobs still have to be recovered relative to the level in February 2020.

Employment in the warehouse and storage industry has exceeded the pre-pandemic level by about 103 thousand jobs with the surge of e-commerce sales during the pandemic to a 12-month total of $867 billion, an increase of $152 billion dollars compared to the 12-month total in February.

INCREASE IN OCCUPANCY FOR INDUSTRIAL SPACE OFFSETS LOSS IN OFFICE OCCUPANCYLeasing activity is also picking up: a lower fraction of respondents—51%—reported a decline in leasing activity from the past year. In the third quarter, 58% of respondents reported that leasing activity was lower than the long-term average.

Leasing activity is accelerating for industrial properties with the acceleration of e-commerce sales. In 2020, 268 million square feet of industrial space was absorbed by the market on a net basis in 2020, up from 241 million in 2020. The largest net increase in industrial space occupancy were in Atlanta, Dallas, Pennsylvania (along I-81 corridor), the Inland Empire (Riverside-San Bernardino), and Chicago.

Meanwhile, with 24% of the workforce still working from home and 1.2 million jobs still to be recovered in office-using jobs such as information services, financial activities, and professional and business services, 98 million square feet of office space was released into the market.

TREND TOWARDS SHORTER TERMS LEASES AND SMALLER OFFICESAs of December, 24% of the workforce is working from home, compared to just 6% prior to the pandemic. Among those in professional and business services, the fraction is much higher, with two in three workers still working from home. The impact of the working from home on the size of the office space and the length of the lease term is still evolving, but the trend seems to be moving towards smaller offices and shorter lease terms, according to a survey of REALTORS® who participated in NAR’s 2020 Q4 Quarterly Commercial Market Survey. A majority of respondents—63%—reported that they are observing an increase in short-term office leases of two years or less compared to the pre-pandemic period. Additionally, a majority of respondents—69%—reported that companies are moving into smaller offices.

| Key Results of the 2020 Q4 SIOR Survey on Industrial and Office Market Conditions - 51% of respondents reported that leasing activity was lower compared to one year ago (13% in 2019 Q4).

- 23% of respondents reported a decrease in asking rents from one year ago (3% in 2019 Q4).

- 33% of respondents reported higher vacancy rates compared to one year ago (20% in 2019 Q4).

- 35% of respondents reported adequate to extensive subleasing availability (4% in 2019 Q4).

- 40% of respondents reported discounts for tenants (14% in 2019 Q4).

- 40% of respondents reported development activity is minimal to non-existent (15% in 2019 Q4).

- 19% of respondents reported site acquisition costs are stable or falling (6% in 2019 Q4).

- 38% of respondents reported investment pricing conditions are below replacement cost (33% in 2019 Q4).

- 39% of respondents reported local economic conditions have a negative effect on the market’s performance (33% in 2019 Q4).

- 47% of respondents reported national economic conditions have a negative effect on the market’s performance (20% in 2019 Q4).

|

1-240 respondents